State Government Land Valuations

The State Government, through the Valuer General, issues an annual “value” of the land component for every property.

But what is the true value of an owner occupied property?

- The value of the property to the owner, represented by the price paid for the property. This is influenced by factors like supply, demand, and market conditions.

- The value to a nation’s economy. Over time the owner will amass greater wealth than someone renting. They will be able to spend more on consumables, holidays, kids activities etc, thus increasing employment and adding value to the general economy.

- The value to Government. Governments are responsible for the wellbeing of their citizens and establish goals to achieve this. For example “Secure and affordable housing is fundamental to the wellbeing of Australians” (Australian Institute of Health and Welfare, 2023). When this objective is not achieved (eg. for renters) there is significant additional cost to government. The value of an owner occupied property includes it’s value in helping to achieve Government objectives. According to Kelly (2025):

- “Two in three retirees who rent privately owned homes live in poverty and the problem will get worse”.

- “Most older working Australians who rent do not have sufficient savings to keep paying rent in their retirement, according to the report from the Grattan Institute.”

- “Coates called on the governent to lift Commonwealth rent assistance, which supplements the age pension for less well-off retirees who rent.”

Value to government includes the value of future savings, particularly in welfare programs.

State Government land valuations only consider the price paid for land in the current market. They provide an estimate of current price for the purpose of calculating tax, stamp duty, rent and rates. They are not valuations, they are Price Estimates but they are used as reliable valuations as a basis for investment decisions.

True Land Valuations

A true valuation would take into consideration the value of home ownership to the community and to government, to ensure all levels of government worked together to achieve their objectives. Increases would be much closer to increases in the consumer price index and housing would remain affordable. Most of the increase in house prices come from higher land valuations.

The Valuer General (VG) valuation of land by price alone has effectively set a floor under property prices. They legitimize exorbitant increases due to supply and demand and other factors (eg. Federal Government tax concessions for investment properties).

These exorbitant prices are never corrected. They are absorbed into land prices by developers who release land at even higher prices in times of high demand, resulting in higher VG valuations.

In the last 42 years I have had only one Site Value that was lower than a previous one, and that was only after I objected to a valuation.

The Land Valuation Act 2010

The Queensland Government Land Valuation Act 2010 states that “If land is unimproved, both its site value and its unimproved value are its expected realisation under a bona fide sale.” (View – Queensland Legislation – Queensland Government, 2025).

What defines a bona fide sale?

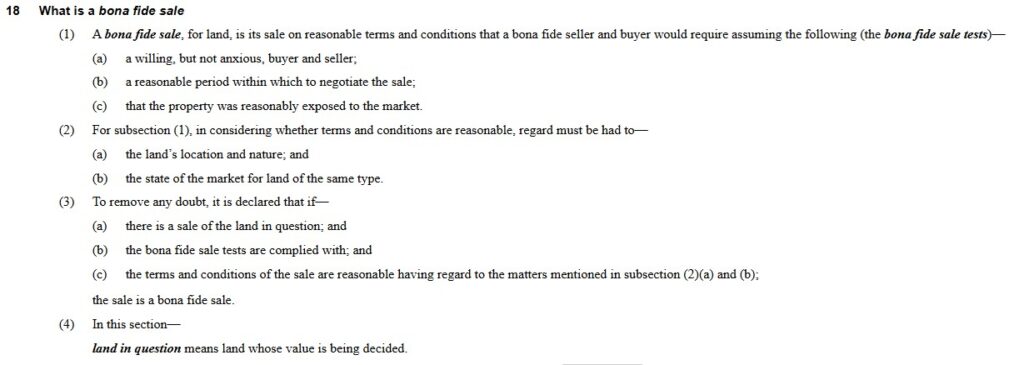

The Land Valuations Act 2010 defines a bona fide sale as shown in Figure 1.

The Act requires that sales considered for valuation must meet certain requirements:

- The buyer must be “not anxious”

- There must be a reasonable period to negotiate the sale

- The terms and conditions of the sale must be reasonable

- The sale must have regard for the state of the market.

Figure 1: What is a bona fide sale (View – Queensland Legislation – Queensland Government, 2025).

In a market where demand far exceeds supply, sales are often by auction (ref 18(1)b), news reports are continually referring to the housing crisis, housing affordability is a key issue in Government elections, property prices are exorbitant, interest rates are relatively high and most first home buyers cannot raise the required deposit.

How can any sale be regarded as meeting the bona fide sales test?

These are surely unusual circumstances.

- What buyer would not be anxious?

- What sale would be at reasonable terms and conditions considering the supply vs demand conditions of the market?

- Do any buyers in an auction have a reasonable period within which to negotiate the sale?

- Are sale parameters such as anxiety level, terms and conditions or period for negotiating a sale even recorded for sales?

The Role Of The Valuer General (VG)

The Valuer General (VG) has discretion on when annual valuations are done.

(1)The valuer-general need not make an annual valuation of land in a local government area if the valuer-general considers it is not possible to do so because of unusual circumstances (View – Queensland Legislation – Queensland Government, 2025).

Valuations should not be done in times of crisis such as we have now.

If governments don’t like losing the extra revenue they get from exorbitant prices they should consider the voters whose dreams of home ownership they are destroying, and govern according to their stated policies.

Considering Warren Buffet’s quote “Price is what you pay, value is what you get”, one can see that the government gets a lot of value from owner occupied home ownership, but pays nothing for it.

In the 2022-23 financial year, the Australian government spent $4.7 billion on Commonwealth Rent Assistance, increasing by $1.9 billion in 24-25. This is about $6600 per person per year.

“Price is what you pay, value is what you get.”

Warren Buffet

The Labour Party is proposing to spend $800 million to help 10000 low to mid income first home buyers in exchange for up to 30-40% equity in their home. This could potentially save the government $1billion (in today’s dollars) in rental assistance, while providing a considerable boost to Australia’s economy.

This suggests there would be good value for the government in granting low-mid income first home buyers up to 80% of their deposit, without any equity exchange.

The requirement for equity sharing further demonstrates government’s treatment of housing as an investment.

The housing crisis will only get worse until governments stop focusing on the price of the investment and realize the true value of land.

References

Australian Institute of Health and Welfare. (2023, April 5). Home ownership and housing tenure. Australian Institute of Health and Welfare; Australian Government. https://www.aihw.gov.au/reports/australias-welfare/home-ownership-and-housing-tenure

Kelly, C. (2025, February 9). Retirees who rent “really struggling” financially, researchers say – and the problem is getting worse. The Guardian; The Guardian. https://www.theguardian.com/society/2025/feb/10/retirees-who-rent-really-struggling-financially-researchers-say-and-the-problem-is-getting-worse

View – Queensland Legislation – Queensland Government. (2025). Qld.gov.au. https://www.legislation.qld.gov.au/view/html/inforce/current/act-2010-039