How State Government Land Valuations Are Contributing To The Current Housing Crisis

Land is an essential resource for everyone, like air and water, and should be available to all households at a fair price.

Everyone has to live on land, everyone has to drink water, everyone has to breathe air. These are all essential commodities.

Air is plentiful and is cared for by government through pollution controls. It is free. Water is generally plentiful but can be in short supply in times of natural disasters (eg. drought, flood or fire). It is managed by government to ensure supply and quality and the consumer pays to cover supply costs. Prices are in the form of government fees which are generally tied to CPI increases and are not market driven.

The Land Market

Land however is not in plentiful supply in the form or location users require.

It cannot be moved and must be developed to meet standards required for a healthy society. This development is undertaken mainly by the private sector. In order to support this, government values land as an investment, with the result that land is now priced beyond the means of many Australians. This causes more people to rent which attracts more investors into the housing market. This is encouraged by the government to provide more rental accommodation, by allowing generous tax concessions for investment properties. Wealthy investors seeking tax benefits plus lucrative profits create upward pressure on property prices, so more have to rent, so more investors are needed, so prices go up, and on the cycle goes.

Land is an essential resource for everyone, like air and water, and should be available to all households at a fair price.

Its development is a commercial undertaking that needs to be paid for in the price of land when a new lot is created, but subsequent land valuations should be tied to CPI increases. Governments receive taxes, rents and rates to cover their costs of administering land ownership and related services and infrastructure.

The Value Placed On Land

The primary recognition of the value of land is obtained from State Government valuations based on the Market Value of land as either Site Value in urban areas or Unimproved Value in rural areas.

The problem with this is that a fair Market Value represents the value of a product or service in a normal market where supply and demand are evenly matched. Market Value will fall if there is over supply and rise in times of excessive demand. However, prices will return to a fair price when supply matches demand.

The release of land is often limited by slow Local Government approvals, creating systematic high demand and high market prices. Unlike other products and services these cycles can span several years, not months. State Governments may issue new valuations at exorbitant land prices several times through these cycles. As these valuations are vital input into land investment and development decisions, land values do not return to pre-crisis values.

Government valuations set a floor under the price of land.

A personal example

The cumulative result of this is that my land has increased in site value by 44,000% since I bought it in 1969 for $1750. It is now has a site value of $770,000! If it had risen at the same rate as gold it would be worth $145,000 today.

In a market where demand exceeds supply, developers will match Government land valuations when they bring new stock to market, even if the cost of developing the land was much less.

If the Federal Government can intervene in electricity prices, why can’t it intervene in land prices?

The Price of Land vs The Price of Gold

Another way to understand this is to look at the price of gold and the effect of not allowing the price to fall by more than 4% in any year. Over the same time gold has risen 8,300%. With a -4% floor it would have risen 45,000%.

This is precisely what happens with the State Government land valuations.

Another essential resource, produced by the private sector, is electricity. The price of electricity almost doubled in the decade to 2019 causing a lot of discussion and concern in the media. A default price was introduced on July 1, following a decision by the Australian Energy regulator.

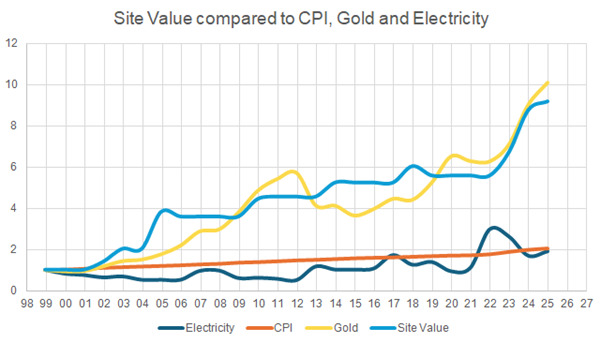

The above chart shows how increases in the price of gold (which has surged over recent years) and electricity are typically followed by a fall. The price of land increases in steps.

This is clearly not how a normal market behaves.

The price of land needs to be regulated by government, just as the price of other essential commodities and government services is regulated.

Land Values and CPI

Over the period 1999-2025 electricity prices have not risen more than the CPI. Over the same period land values have increased 4.5 times as much as electricity.

What does the Government do? Periodic land valuations to legitimize the exorbitant increases and ensure they don’t go down again.

If the Federal Government can intervene in electricity prices, why can’t it intervene in land prices?

Could it possibly be because so many politicians own investment properties? 44% of federal politicians own at least 1 investment property compared to 15% of Australians.

Am I happy that my land value has increased so much? NO. Because my grandchildren will not be able to afford the deposit to buy a house if this continues.

About

As someone who is concerned about the impact of land valuations on the Australian economy, Keith draws on his experience to highlight the issues that need to be discussed and addressed.

Recent Posts

Categories

Valuations